Forum Energy Technologies: The Variperm acquisition has tech like margins.

At 3.5 times free cash flow with buybacks initiated it looks like the market completely missed their recent acquisition.

I looked at FET a couple years ago while searching the energy sector for investments. What caught my attention initially was management’s free cash flow guidance compared to the where the stock was trading. If they were able to up their margins on their large revenue stream the stock had good potential.

Two things stopped me from investing in FET 1) the lower than anticipated cash flow they generated at the time and 2) management intended to make an acquisition and I generally prefer buybacks over acquisitions because many management teams aren’t very good when it comes to acquisitions that drive value.

After revisiting the stock I think the FET management team proved me wrong with their recent acquisition.

I looked at the stock again about a year later, at a much lower price and noticed they had they recently acquired a private Canadian services company called Variperm in the oil sands region. After catching up on the stock and looking at the impact of the acquisition on FET, it looks like possibly one of the better acquisitions I have seen a company make. The company’s cash flow has jumped significantly while the stock is trading at 3 year lows. I’ll go over the details and numbers later below.

FET operates in the energy space and provides services to exploration companies. They mainly operate in the US, and now with the acquisition also in Canada, but also have international operations. They manufacture and buy inventory, warehouse that inventory, and provide capital equipment for their general services for upstream players in the sector. They use a mix of consumable and repair parts stored in regional warehouses and ensure timely availability for use for their customers. For this reason, they carry more inventory and working capital on their balance sheet in addition to the equipment they carry for their more capital intensive business.

So why is the stock now so cheap?

The history of the company might have something to do with it. In the summer of 2020 they warned that they were on the verge of bankruptcy if they could not refinance, at the time, their old 6.25% notes which were due in 2021. After initially having trouble exchanging these notes they were finally able to make a deal with holders, but it came at a cost. These notes were not only convertible (to equity) but they also and charged interest at a much higher 9% coupon. In total, they exchanged and refinanced $250 million worth of this new debt due in 2025.

The debt had a feature where 48% of the notes would eventually be converted into shares. While they avoided bankruptcy they ended up holding much more expensive bonds with additional dilution for shareholders. Overall this was likely not something the market would have been happy about.

The notes eventually converted in early 2023 when the stock was trading near $30 and the other non-covert (52%) portion of the notes stayed on the balance sheet. The stock is now around $14. Interestingly, after the conversion my first thought was this stock is going to get a lot of selling pressure. I don’t think debt holders had much interest in owning the underlying stock, which is often true in these type of restructuring situations. The stock did eventually go down but more like a melting ice cube but it was a much slower and orderly sell-off than I anticipated. Regardless, this was likely one of the non-company specific issues that put pressure on the stock.

In addition, the stock also has low liquidity, it looks like analysts stopped following the stock, and it wouldn’t have screened to too well for hedge funds/potential investors historically. On that note, it still likely screens poorly because the impact of the Variperm acquisition has yet to be fully realized for the company and its financials.

Another possibly very important reason why the market may have not caught on is the depreciation and amortization on the income statement in 2022 and 2023 totalled $37M and $35M, respectively, while capital expenditures from the cash flow statement for 2022 and 2023 were $7.5M and $8M. The mismatch between the income statement numbers which are much higher vs true outflows of cash for capital expenses makes the company look much less profitable than it actually is. Basically the income statement would not screen well despite the company being quite profitable.

Also note that this discrepancy is even bigger after the acquisition of Variperm in 2024 and Q3 YTD depreciation and amortization is $41.5M vs capital expenditures of only $5.7M, a $35.8M mismatch. Is the market missing this? I don’t know but based on what I have seen I wouldn’t be surprised if this has been missed by many in the market.

Other reasons I believe the opportunity exists that are non-stock specific.

The market seems obsessed with tech, story stocks, momentum and leaving certain parts of the market completely ignored.

Also, the energy is under-owned and still unloved despite being the cheapest sector in the market.

Lastly, there aren’t too many value oriented firms and hedge funds left in the market and hence not a lot of buyers to look for undervalued companies and push the prices higher to a fair value and reasonable value (intrinsic value). To be frank, it seems the vast majority of buyers in the market aren’t looking at 10Ks or really analyzing these companies. The lower the stock goes, the less the market cares it seems, yet this is exactly when stocks have the highest risk/reward.

So the next questions is why should anybody buy this stock now?

Very simply with the new acquisition, they are likely to generate $50-60 million dollars a year in free cash cash which is a 28%-33% yield at current prices. And they have de-risked the balance with a new debt due in 2029 while paying off the old notes (the remaining portion of the convertible bonds). The remaining debt is the company’s revolver which can be paid off as cash comes in.

Also they plan on de-risking the balance sheet even further by lowering their leverage ratio to 1.5X in the next 6-12 months. At that point they plan to return capital to shareholders in the form of buybacks. This is a significant shift in capital allocation priorities from when I looked at it a couple years ago.

Why do I think they will be able to generate $50-60M a year? Because post acquisition, the last 2 quarters are showing the free cash flow to be roughly in line with that figure.

It looks like the market hasn’t digested the recent Variperm acquisition and it’s impact on the company. Included below is the 8K filed by FET regarding the acquisition.

https://ir.f-e-t.com/static-files/97378fe6-ca5e-4d37-b720-f51d323f1534

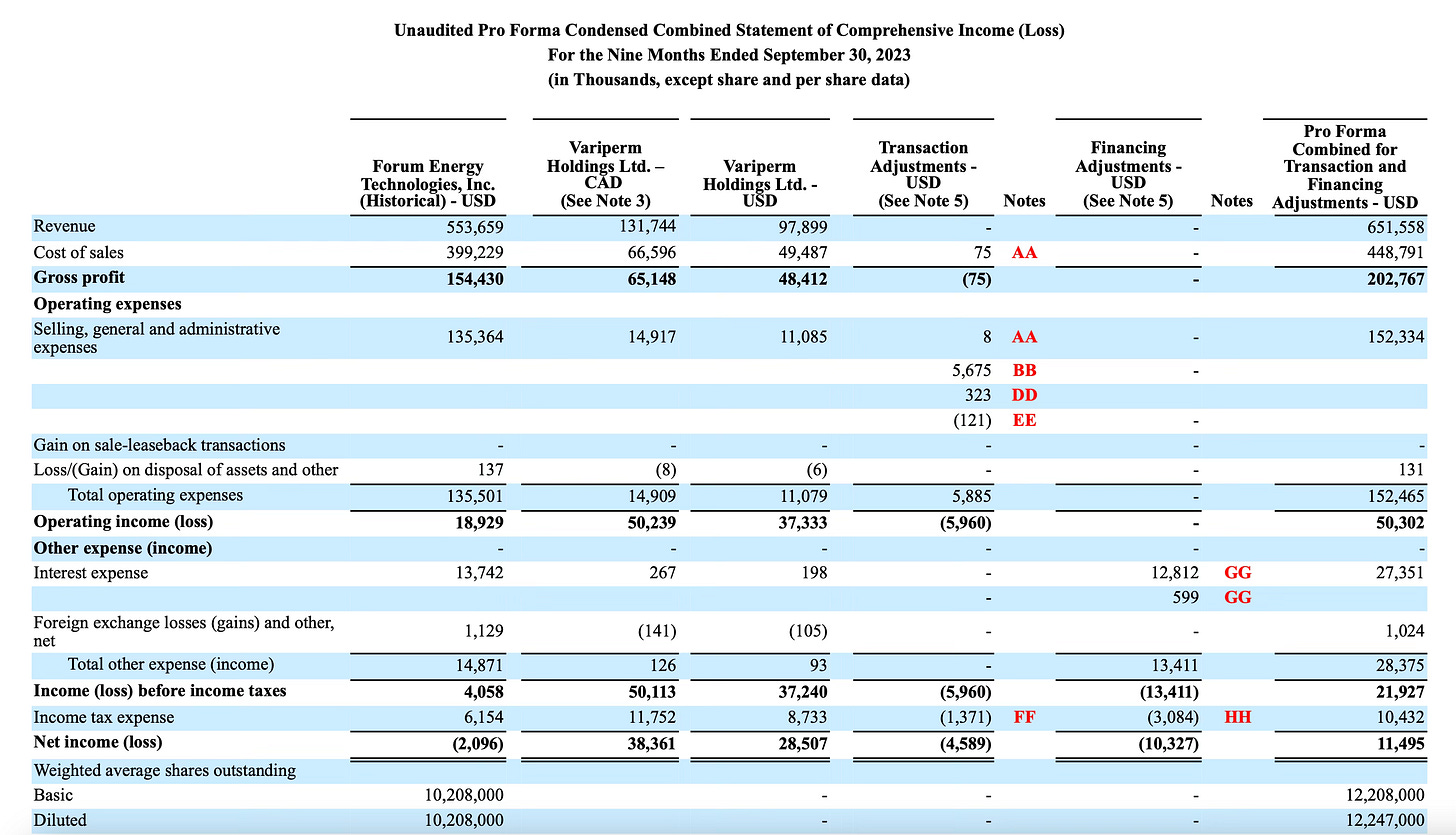

Variperm operates in the same sector as FET, and specifically focusses on manufacturing customized downhole technology solutions for their customers. Going through Variperm’s financials in the 8K you’ll notice they made $40 million CAD in free cash flow in 2022 (after capex and taxes with no debt) and about $40 million CAD in free cash flow YTD up to Q3/2023 before the acquisition, which would roughly be a $50M+ run rate for the full year.

The numbers above are for three quarters in 2023 and Variperm’s operating margins look like a tech services company. A very high margin business with low capex spend.

FET purchased the private company for $150 million in cash and 2 million in shares when the price of FET was roughly $22. In total they paid $194 million USD for a company generating roughly $37 million USD in free cash flow (I used the average conversion rate for 2024 of .75 for CAD to USD).

Based on FET’s current market cap right now of ~$185M, Variperm standalone is generating about 5X free cash flows on FET’s equity excluding FET. The question is can we expect Variperm to generate 2023 numbers in the future? Management was asked about this in their recent conference call:

Neal Lux, CEO

“Yes, Dan. I don’t think there was any large projects that were unusual that they delivered in 2023. I think as we look ahead and as we modeled the business, our focus was looking at – what’s the kind of demand that’s going to come from the maintenance drilling, right. Just to keep production flat. And I think that’s where our expectations is that 90% to 95% of the go forward was really just to make up for declining activity or declining production.

Lyle Williams, CFO

“Yes. And Dan, I would just chime in on that. If we look back over time at the business, they’ve got a really great correlation with energy prices and with activity very similar to our business and probably mirror the more activity driven side of FET rather than the bit lump, more lumpy capital side of FET. So expectation is that over time this will be a dampener of volatility on combined FET revenues.”

In a nutshell, according to management most of the revenue Variperm generated in 2023 was from maintenance capex projects that are required every year to keep production flat by their customers. If this is in fact the case, Variperm’s earning should should hold up and remain steady for the foreseeable future. And to note, the area where Variperm operates consists of oil sand drilling which is much more stable and consistent as they can’t turn off projects unlike shale drilling projects in places like the Permian basin.

In addition, in the 8K you’ll notice that Variperm spends very little on capital expenditure, which management confirmed:

Daniel Pickering

“Okay. And the kind of historical information that you showed in the acquisition press release highlighted, they had a couple of million bucks of CapEx on a trailing 12-month basis. That’d be your expectation. So, low capital intensity here for the business?

Neal Lux

“Absolutely. It’s a strong conversion of EBITDA to free cash flow, which I think is something that really drew us to this business along with what the team has been able to accomplish and the technology, the customer relationships, and then the outcomes they have, I think just really are all fantastic.”

Management also noted that Variperm has been working with the larger players in the region and built good relationships for up to two decades. Although there are always risks it adds some comfort that the revenue will recurring into the future.

Overall you have optionally here. FET still generates cash on top of Variperm’s free cash flows and any upturn in the oil and gas sector will benefit FET’s business. In a base case, if oil and gas rigs and capital expenditures stay flat, then you generate a 30% free cash flow yield.

So you have a margin of safety with Variperm with potential upside from legacy FET and the cash from Variperm will be used to pay down debt and reduce interest expense making the combined company more profitable as time goes on. So even in a base case scenario debt goes down and the free cash flow goes up.

If the energy market turns upwards this could be a home-run, legacy FET has significant potential upside potential for the stock as the market is not giving their cash flow generation ability too much credit. The asymmetrical nature of this investment makes it very compelling and it only gets better if they generate this kind of cash and reduce debt.

Another interesting tidbit, their net current assets (excluding the current portion of long-term debt because this doesn’t reflect the working capital required) is $321M. You can look at that as the assets and liabilities needed to run the everyday business. That is significantly above the current market cap.

Just as an exercise to get some perspective, if management decides to close some of their operations and liquidate a portion of their inventory relating to the less profitable operations they could raise cash and pay down debt, possibly by a lot.

Assume that after the Variperm acquisition management takes a second look at the whole company and decide 20% of their operations are not profitable enough. If they reduced their Q3 2024 inventory by 20% (286M X 20%) and shut in these segments they could generate $83M ($57M at 45% markup estimated from the income statement) and nearly pay off half of their debt.

Hence they would carry less debt, interest would drop significantly, they could focus on their more profitable divisions like Variperm, and the stock would likely get re-rated higher. Will they do this? It’s unlikely but it provides another way to look at the margin of safety in the stock based on their net current assets and ability to pay off debt quickly if they had to, while keeping the cash cow that is Variperm.

Valuation:

Management’s guidance for 2024 is $60-70M in cash flows and this includes working capital changes. Although what I call “true free cash flow” is lower this year. First, they had about $11 million in transaction costs with the Variperm acquisition which is a one time occurrence.

After making the accounting adjustments to back out the noise I calculated their YTD free cash flow/owner earnings/true free cash flow around $35M if you back-out the Variperm transaction fees. This would put them close to $45M-50M in run rate free cash flow for the year…..(note I would I am always willing to get feedback on my numbers if anybody wants to add input).

The second reason why true free cash flows should be higher next year is that money generated this year and early next year will reduce debt. Interest expense in 2025 should be about $5M-10M lower and should continue to drop. This should put them above $50M in free cash flow in 2025, and lines up with management’s guidance for 2025.

Their net debt should be roughly $190M in Q4 and should be near $150M by mid-to-late 2025. That will put their leverage ration in the range of 1.5 or lower. At that time they will be able to return cash to shareholders. A couple notes on that topic directly quoting management from last quarter’s conference call:

*(Edit: based on new information on free cash for the year and the recent sale-leaseback this should drop to $165 million at Q4).

Neal Lux, CEO

“Yes. Eric, I think as you were talking there, I think you laid out really the evaluation that we do, right? I think when we look at acquisitions, is that investment in the acquisition going to increase our free cash flow per share or are we better off using that capital to buy our shares? And I think that will be the threshold that we analyze going forward. And again it is hard to find something as attractive as our own stock. 30% to 35% free cash flow yield, it's hard to buy companies like that. If we find one though, it'd be we may snap that up if it's better, but all signs I think right now point to we're probably one of the best investments that you can make.”

Lyle Williams, CFO

“Second, the bonds permit distribution of cash to shareholders. Specifically, the bonds allow shareholder distributions of up to 50% of prior year adjusted free cash flow when our net leverage ratio is below 1.5x pro-form a for the distribution. We will calculate the amount available for 2025 after filing our 10-K next quarter. However, assuming our free cash flow guidance of $60 million to $70 million for 2024, we would have $30 million to $35 million that could be distributed once our leverage is below the incurrence threshold. That is over 15% of FET's current market capitalization.”

The CEO stated that buying their stock is the best investment they can make right now with free cash flow yields of 30%-35%. This is a good sign and that is what you want to hear from management when their stock is trading at these levels.

However, as the CFO mentioned there are covenants on the new 2029 bonds that restrict distributions until they reach a leverage ratio of 1.5 times and then it allows 50% of the previous year’s free cash flow to be distributed to shareholders.

You can view this as somewhat a negative as they will be restricted in the near term, but considering 50% of cash flows would equate to 15-18% of the stock’s market cap that should be more than enough to reduce share count and move the stock. And to be honest I wouldn’t mind management using the other 50% to continue to pay down debt further which in itself should make the stock screen better for investors and likely expand the stock multiple.

Free Cash Flow estimates on a base case:

Net debt at Q4 is a little difficult to estimate because of how working capital fluctuates in Q5 but currently it is under $200 and about $10M of cash is expected in Q4. Assuming net debt is $190M at year end here are some cash flow scenarios for investors.

If they generate $100M in EBITDA next year. Interest is expected to be roughly $25M on total debt, with capex of $10M and taxes of $15M. Free cash flow would be $50M in this scenario, yielding about 28% on current equity prices.

If they reduce their debt with all the free cash flow, at YE 2025 net debt should be $140M and the corresponding interest payments will drop by roughly $7M and run rate free cash flow should jump to about $55M after tax, a 30% yield.

If management’s higher end guidance of $110M in EBITDA is met, that is roughly another $1 decrease in interest expense from debt repayments and roughly $9M after tax in free cash flow, a 34% yield [($55M + 9M)/185M].

FCF estimates based on potential buybacks.

Assuming $30M of free cash flow is used to buyback shares, at current prices that is 16% of shares outstanding ($60M 2024 FCF X 50% ~ 30M divided by a market cap of $185M). In six years they could buyback the whole company while keeping $20-30M a year for more debt reduction and/or potential dividends or acquisitions.

Assuming buybacks start in mid-2025, with 12.3 million shares outstanding they could reduce share count to 8.2 in mid 2027 assuming 16% of shares a year are retired. Free cash flow per share on $50M would jump from $4 to $6 and debt drop to $100M or lower with the remaining excess cash. The stock currently has an EV/FCF of 7.7 [(200M + 185M)/50]. If it maintains that EV/FCF multiple in mid 2027, lower interest will add another $10M of free cash flow and the stock would be near $44 ($60M FCF X 7.7 = $462M, less of $100M debt = $362M/8.2M shares outstanding), a nearly 200% upside.

Average volume is 45,000 shares traded a day so nearly $700,000. If they maximize their buyback up to the 25% daily limit you are looking at $930,000 in volume a day with about $230,000 of shares retired a day and and about $1 million a week. So on paper the stock is liquid enough for management to buy up to $50M in stock next year. However I think it’s much more likely that when they start buying the added buying pressure will push the stock much higher. Note that I have noticed this trend in several of the energy names that I have followed where the company initiates a buyback and the stock jumps and continues climbing higher. I believe the lack sellers in the energy space after years of underperformance and the market’s completely ignoring these names is creating upward pressure where demand outstrips supply of these stocks.

In conclusion, you have the added benefit of and a catalyst coming in 2025 where management intends to use a significant portion of cash to buyback the stock. So either they buyback stock the market doesn’t care and they reduce their share count by nearly 20% each year until the stock has to move up based on earnings jumping on less shares outstanding or they push the stock price up simply by being the only significant buyer in the open market until investors and the algos catch on.

So I have covered why the stock looks significantly undervalued and you have catalysts coming in the form of buybacks. So what could go wrong and how could you hedge it?

Risks

The biggest risk is 1) a crash in oil prices 2) lower oil prices reducing capital expenditure in the sector and a corresponding drop in rigs.

The first scenario is the real risk with all energy companies and shouldn’t be discounted. Oil is a commodity that is exposed to supply/demand dynamics an one off events that aren’t predictable.

The second risk, lower oil prices and capex in the sector, is also a risk for FET because free cash flows would likely drop. However note that in 2024 oil prices and active rigs dropped and FET/Variperm have still been able to generate plenty of cash. And considering the price of the stock and their current yield they could still generate good returns.

Despite this I am still hedging my position. As noted the biggest risk here is a fall in oil prices beyond short-term volatility. I have quite a few cheap energy stocks I own so to hedge this risk I opened index puts and specifically puts on the XLE. If oil crashes, historically the XLE has had a pretty steep drop off (close to 50%). This should at be a good insurance bet against energy plays to hedge a worst-case type scenario. I also opened puts in the XIU which is a TSX index ETF, which would have a bigger sell-off than say the SPY as it is more concentrated and has a much higher exposure to energy in general.

Another potential risk is that Variperm was a private company so we don’t have much information on their history, client base, and we don’t have access to past presentations of conference calls to get the full story. However, FET’s management did note that they have been looking at and following the company for years and, as noted earlier, most of Variperm’s revenue will likely be recurring. Though there could be a risk that FET’s management misread the situation and/or revenue streams drop at Variperm there is some comfort they have some history following the company which should lower risks.

Another risk maybe worth mentioning that in my view has is is FET’s management making a bad acquisition with their remaining funds in the future, however with management’s comments on on the share price, free cash flow yield, and buybacks I think the risk of this occurring has diminished pretty significantly. Also with the acquisition of Variperm I might have initially underestimated this management teams capabilities. Note that the Neal Lux the current CEO came on board in 2022 and was not responsible for the mishaps of the company in the past.

Overall the asymmetrical nature of this investment with the high free cash flow yield, the coming reduction in debt and interest expense, with share buybacks as a catalysts, and potential upside on higher oil prices makes the new combined FET/Variperm a low risk high reward investment at this level.

Hi, thank you, I enjoyed this great write-up!

I wanna dig deeper myself, but one question that came immediately to mind. Is it a mistake of a data provider, or did they indeed have negative FCFs in 6 out of 8 last years (since 2017)? And net income was negative in each of them. Do you know the reason?