KLXE Part 1: A dirt cheap stock with a lot of upside potential.

The company generated $63 million in free cash flow in 2023 and the equity is currently valued around $100M.

Quick overview:

The company generated $63 million in free cash flow in 2023 and its market cap is hovering around $90 to 100 million.

It has good exposure to natural gas and prices have recently turned upwards and I expect supply to continue to drop below the 5 year average (see my article on natural gas I believe nat gas is going into a structural deficit).

One or two good years and this could be a multi-bagger simply from where the stock is trading and lower debt.

Their financials don’t accurately reflect their true earnings power and it likely doesn’t screen well.

They are effectively a net-net so there is downside protection with assets significantly above debt and equity which gives shares and equity a lot of upside, valued at ~$500M by an independent third party.

It has a 9% short interest with low volume so you could see a move up on short covering alone. To be frank, I have no idea why anyone would short this stock at these levels.

I expected KLXE to do better as a post-election play in energy services companies that should benefit from more lax policies however my intuition tells me the stock is not trading on fundamentals or prospects, it seems to just be “hovering”. The company also has very little coverage and is under-followed.

KLXE focusses on critical oilfield services for oil and gas companies for technically demanding wells including directional drilling, coiled tubing, hydraulic frac rentals, and other well control services.

They operate in three regions; the Southwest Region (the Permian Basin and the Eagle Ford), the Rocky Mountains Region and the Northeast/Mid-Con Region (gas focussed regions).

As for the history of the company, it is an energy services company that was spun off in 2018 after a bunch of smaller private companies merged. It subsequently went on a sort of shopping spree to acquire a bunch of other smaller services companies. They achieved one goal in this process which was to increase revenue and gain scale as the combined revenue jumped from the all the acquisitions.

As far as management I would say they are ok. Going back and looking at their projections and conference calls they seem to be overly optimistic and have missed their revenue targets in the past. It looks like they just tried to grab every company they could and create some sort of scale without much strategic planning. And they are also in a very competitive environment and are up against other larger and well managed competitors in the industry.

But the stock looks too cheap at these levels. Looking at the financials for 2023 and 2024, it seems all the acquisitions provided them enough scale and they are now profitable with lots of leverage to any upside in the drilling and activity in the oil and gas sector. A not-so good company can still be very a very attractive opportunity at the right price.

Right now the market cap is roughly 15% of revenue, so the market is giving the company very little credit for the scale they achieved. And the market is likely worried about their $200M in debt, which is significant yet manageable and provides opportunity for the stock to move if they can reduce it near term.

Besides company specific reasons, there is also the fact that these small energy stocks get no attention from Wall Street because they are too busy upgrading their NVDA and CVNA targets.

So why did it drop in 2024?

As far as company specific issues revenue went down in 2024 as active rigs in oil and gas dropped significantly from 2022/2023 levels. Just to give some perspective, they lost a run rate of $120M in revenue from their Northeast/Mid-con natural gas division. The region had EBITDA margins above 15% in 2023 so about $20M or more was lost that would have mostly hit the bottom line on a $100M market cap stock.

Update: Gas prices have moved a lot since I wrote this article.

So why does this stock have potential?

Simply put they generated $63 million in free cash flow in 2023 and the current market cap is ~$100 million. In 2023, before working capital changes the company generated ~$63M in free cash flow with EBITDA of $138M less $57M in capital expenditures and less $35M in interest expense plus $16M asset sales. Note that the $16M in asset sales seems to be a stable/recurring part of their business and they sold a similar amount in 2022.

Are there any reasons to be bullish in the near to medium turn?

First, with Trump in office it opens the way for capital expenditures in the energy space. Second, if you read my post on natural gas you’ll know why I am bullish for gas production and more capital investment in the coming years, so it’s likely a lot of that revenue comes back in the next couple of years. I am bullish on natural gas because there is a real risk the coming demand in the next couple of years will require much more supply of gas with the risk of a supply shock occurring.

The real benefit with KLXE is that they are generating cash while also highly levered to activity in the space. So even in a pretty bad year they are profitable. The likelihood of capital loss looks low with high potential upside.

But I will add, unlike the other two energy services companies I own which I will cover later, which are qualitatively much better companies, KLXE has higher risk but it also looks to have more upside.

Free cash flow estimates in a not so good year:

In the last two quarters they generated $25M plus in EBITDA in each quarter, but this is expected to go down in Q4. I am going to use $17.5 in EBITDA in Q4 and going into Q1, to provide a conservative estimate. In total that is $85M in EBITDA for the year (compared to $138M last year). This is likely overly conservative and It’s likely they can achieve $90-100 run rate EBITDA in most decent years.

Capex is about $55M, interest expense on the income statement is about $36M and run rate asset sales in about $12M this year. If we do the math we get free cash flow of $6M with a conservative EBITDA in a not-so good year for business:

85 - 55 - 36 + 12 = 6M

But this is misleading and might be the reason the stock doesn’t screen well.

So here is the interesting part: their capital structure and debt. They are paying 11.5% a year on $235M of notes which are due in 2025 and 7.9% on their $50M ABL facility. If you do the math total cash interest paid is about $31M not the $36M shown on the income statement.

They also have $85M in cash sitting on their balance sheet, which they could and should use to retire $85M of the very high interest bearing 2025 notes. This would add nearly $10M in free cash flows ($85M X 11.5%).

The company expects $55-60M of capex for the year, but 20% of that is growth capex. That is about $11M in spending that could be cut. One caveat here is that many management teams are pretty bad at distinguishing growth capex vs maintenance capex. But management has reiterated several times it is in fact growth capex so on the assumption they are correct this would be another $11M in cash flow that hits the bottom line.

Here is my adjusted estimate of true free cash flow (owner earnings) below for 2024:

85M - ~46M capex - 31M interest expense + 10M (in lower interest expense) + 12M in asset sales = $30M in adjusted free cash flow in a conservative year.

Pretty simply, changing their capital structure, reducing their growth capex, and avoiding more acquisitions would boost cash flows and would allow them to pay off more debt and likely re-rate the stock higher. It looks like a low hanging fruit approach for management.

They could then look at potentially returning capital to shareholders and based on the daily trading volume and the short interest which ranges from 8%-12%, even a small share repurchase plan will likely move the stock price higher.

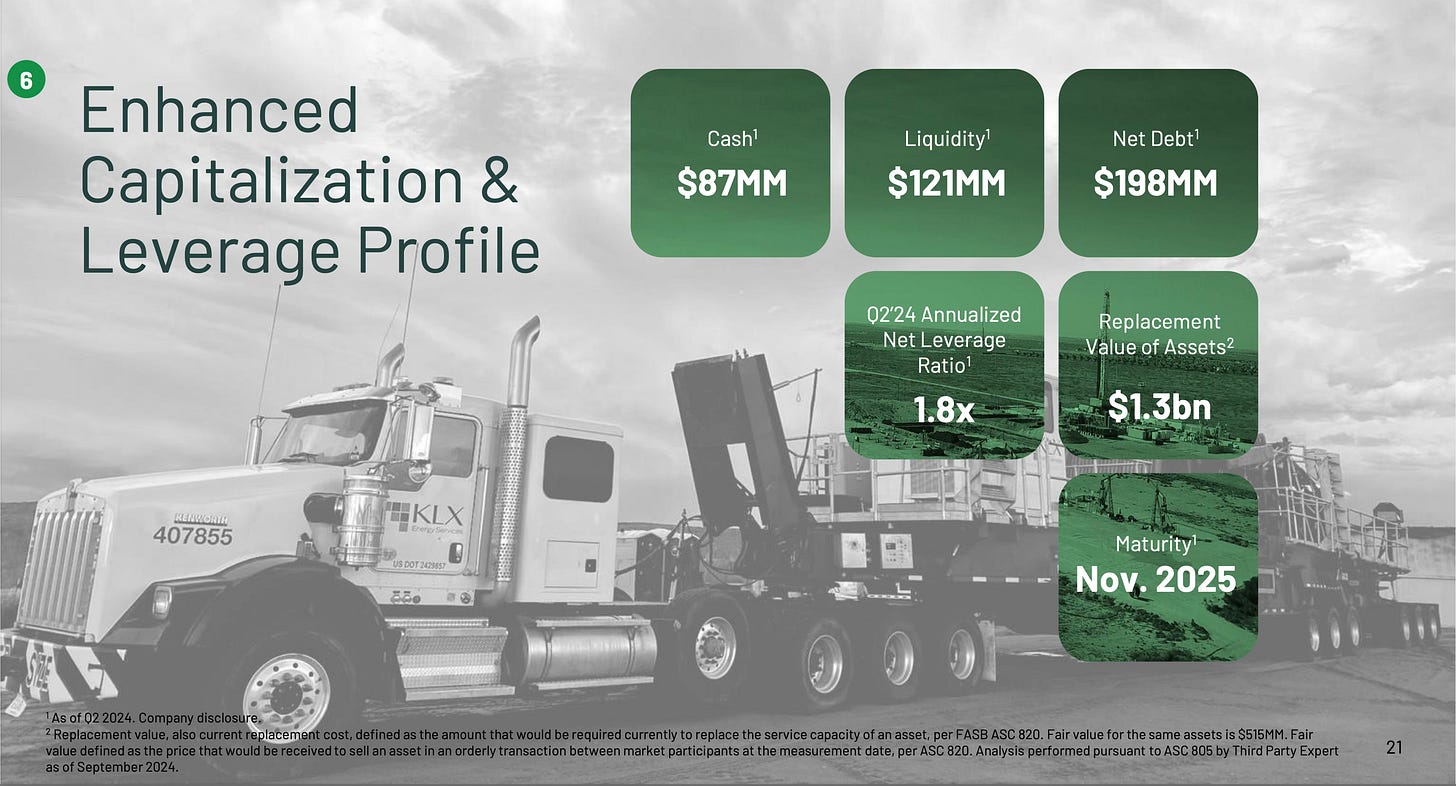

Another interesting note from page 21 of their September presentation:

The replacement value of their assets is listed at $1.3 billion. Optimistic? Likely, however in the footnotes you’ll notice a third party appraiser valued their assets at a fair market value of $515 million. If you look at the assets on an unlevered and standalone basis that does not seem unreasonable as they can likely generate $100M in EBITDA in a base case year with $50M of capex plus $12M of asset sales, hence they would generate about $50M+ in after tax net earnings which is about a 10% cash yield on assets.

This seems reasonable. With $500M in appraised assets less $200M in debt that leaves an equity value of $300M vs a $100M stock price.

Which brings up another possibility, could KLXE sell some of the assets they bought in their shopping spree and eliminate debt further to improve the capital structure?

This might be a good approach in a worse case scenario. Historically they were more interested in growing so for this approach to work maybe this stock needs an activist that is able to nudge the management team toward changing the capital structure and reducing overall risk for the company, while improving earnings. This approach just makes sense to me. Regardless, I still think this investment has a very good risk/reward profile simply based on where it is trading and the optionality from the assets and more activity in the space.