SCR: The best play in oil sands trading at a deep discount.

A oil company started by a PE firm run by value investors with most of their net worth in the company.

The company I am writing about is called Strathcona Resources a Canadian oil sands play. It is now the 5th largest oil producer in Canada. This is a pretty big position for me and my cost basis is $29. You can buy it for cheaper.

All numbers below are in CAD except the price of WTI.

Big picture, this is why I made this a big position:

It is a low quartile cost producer and the “look through” free cash flow multiple is 5X with flat production. In comparison US E&P peers with are seeing little growth and trade at 10X+. And the company has tax assets almost equal to the market cap.

Upper management and the board have most of their net worth in the stock. There is no stock based compensation. Incentive comp is paid in cash and insiders are required to buy in the open market as shareholders would. In effect, insiders are highly aligned with shareholders.

Their growth rate has been pretty phenomenal and they have a growth plan in place for the next few years. With the recent focus in the sector on capital returns this might turn away some investors. However, ex-growth they are still trading at a discount to peers on their six year free cash flow forecast.

When I spoke to the CFO about the growth plan it seems to be pretty low risk and mostly includes adding capacity.

Despite the capital they will spend for their growth plan they will still generate a 11-12% yield at $70 WTI this year and plan to start returning capital to shareholders in 2025. And they can return most of the market cap back to shareholders in about six years as profits double.

It is 81% owned by a PE firm (was 91% up until two weeks ago) and funds can’t buy it yet because of low liquidity and Canadian dividend investors will likely jump in once they start capital returns. And they will soon be listed on the TSX index which should create forced buying.

And importantly, the management team looks prudent, risk averse, is value oriented and has a proven track record.

I came across this investment when I heard Eric Nuttall on BNN mention he met with Strathcona’s leadership and thinks it is a great company, however he could not buy the stock because there wasn’t enough liquidity for his firm to take a position. Eric Nuttall runs Ninepoint Energy the largest energy fund in Canada. So I decided to do more research because it looked like there could be an opportunity resulting from non-fundamental reasons. A poster on another platform mentioned he attended their investor day meeting and the management team are Buffett like in their approach. Interestingly, the first thing that came to mind was Warren Buffett’s previous investment in Suncor Energy which operates in the oil sands region of Canada as well.

After looking through their investor day presentation it didn’t take long for me to decide whether this passed my threshold of a good investment. A great management team, reasonable debt, a cheap valuation, non-fundamental reasons for the stock trading where it is, and with catalysts on the horizon.

After I saw their presentation I had to call management because it looked like one of the more obvious buys in a sector full of bad capital allocators. So I called IR and set up a meeting with the CFO.

Comparison to Peers

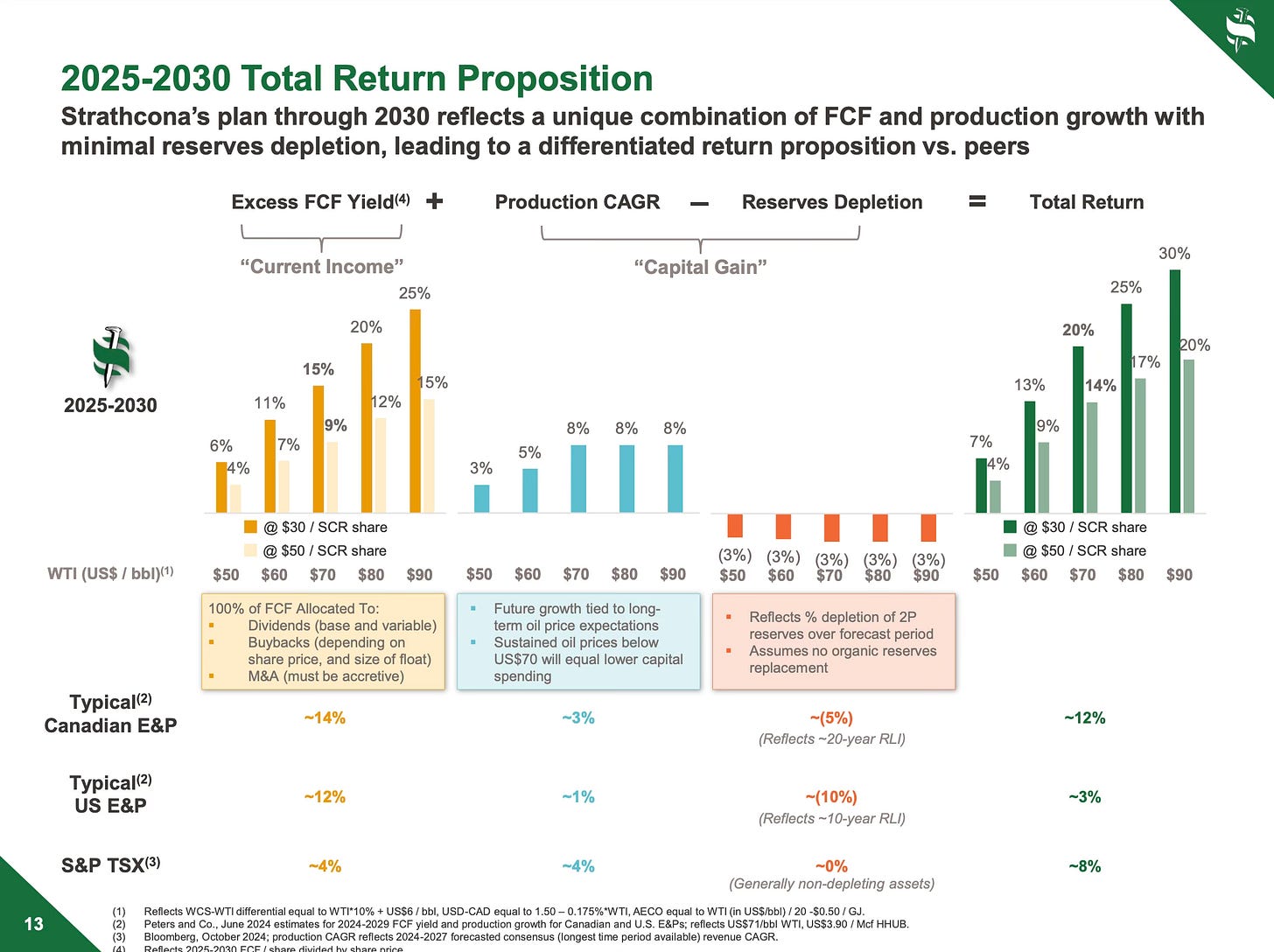

The slide above is from their investor day presentation.

Based on the excess free flow yield and growth less depletion Strathcona is trading at a 20% yield. Meanwhile their Canadian peers are trading at a net 12% yield at $71 WTI. The stock is currently under $30 and even if it traded at $50 (yielding 14%) the company would still be cheaper than their typical Canadian E&P peers.

Management also noted in another slide that they trade at half the valuation on CNQ metrics despite having a very similar production profile.

Compared to most US peers who trade at 10X+ FCF with little or no growth, on an apples-to-apples basis they trade at about half the valuation.

History of the Company

What is unique about Strathcona is that it began operating in 2017 through a private equity firm called Waterous Energy Fund. They initially raised about $2 Billion from private investors and subsequently another $3 Billion in debt. From that capital they subsequently generated $2 Billion in retained earnings and then made numerous acquisitions totalling roughly $6.8 Billion.

Management noted that based on the amount of cumulative retained earnings generated they are the most successful startup in Canada in the last 15 years, which is an impressive accomplishment.

That $2 Billion in equity invested in 2017 is now trading at $6 Billion, yet the intrinsic value is likely much higher (about $12 Billion from my estimates). Management did something right. The company eventually IPOd through a reverse merger in late 2023 and since then the price of the stock hasn’t moved much.

Currently about 60% of their production are wells they have drilled in the last 8 years and the other 40% are from acquisitions. So they have a track record of accretive acquisitions and successfully bringing wells online organically. This gives me comfort for their organic growth plan.

Pretty impressive considering these guys are not industry lifers and came from a private equity background. They are now the fifth largest oil producer in Canada and if you listen to their investor day presentation, you’ll notice their value like approach, which goes against the norm in the E&P sector. When I asked the CFO how he achieved this he implied their firm used a value approach while competitors were more concerned with growth.

Here is their free cash flow forecast for the next six years including their growth plan.

Generally when I calculate the value of these heavy capex businesses my first question is what is the maintenance capital to hold production flat? That way you get a better idea of the underlying value of the business and it gives a much cleaner comparison to peers without the noise and it helps as a measure of risk.

All else equal the company with the lower maintenance capex and all in break-even cost has the better business model. If you have ever read The Little Book of Building Wealth, one of the 4 pillars of a moat is a cost advantage. When the word moat comes up the first thought are usually companies like Costco, Walmart and Apple, however I rarely hear the term used in the commodity space even though being a low cost producer is in fact a real moat.

The company’s maintenance capex with current production of 185K BOEPD (67M barrels per year) is $850 Million. This is based on a break even cost of $43, much lower than their US peers which I will discuss further below.

Their net earnings at $70 WTI with fiat production is roughly $2,050M. This is after accounting for all operating expenses, overhead, interest and taxes but before capital expenditures for maintenance and growth. They have large tax assets that can offset tax payables.

At $70 WTI and holding production flat they can generate $1,230M of free cash flow a year. That is a 20%+ yield on the current market cap.

At $60 oil that drops to $680M an almost 12% yield.

This is where the margin of safety comes in and my main thesis for buying the company and holding long-term. At $60 WTI the average shale producers would at best be generating $6 USD margins while Strathcona would be making $17 per barrel. Some estimates for shale put break even near $54 but interestingly the management team at Strathcona thinks shale is unprofitable even at a much higher break-even.

At $50 WTI shale will be shutting in wells while Strathcona still generates about $330M a year in free cash flow. Shale will go out of business before Strathcona starts losing money.

They have a low cost producer advantage they also expect their break-even to drop to $39 in a few years.

Here is management’s guidance of free cash flow including their growth plan. These are same numbers from the investor presentation slide above but in excel format.

Growth capex will run at an average of approximately $7.50 per barrel and yearly growth capex will average $500M for the next 5 years.

Free cash flow at the end of their growth spend will more than double and the company will generate most of their market cap in the next 6 years at $70 oil while simultaneously growing production by roughly 57% from 185K BOEPD to 290K BOEPD. Generally when companies try to grow production by 55%+ you don’t see this type of free cash flow profile after all that spend.

The company has a reserve life of 39 years. Management thinks that is too long and that is one of the reasons for expediting growth. By growing production they will drop that to 24 years, which makes sense from a NPV perspective. Management is very confident in the company’s reserve life and actually thinks reserves are closer to 50 years.

They also have $5.6B in tax pools vs a market capitalization that is under $6B. This means $5.6B will eventually be returned to shareholders tax free. The only issue is the timing because the rules around tax legislation limit the ability to use these tax assets each year. At $70 oil they don’t plan to pay taxes until 2027.

Based on the above, the NPV of the after tax total cash flows would be roughly $12.2 Billion. I used a 10% discount rate and a 25% tax rate after using up their tax pools. Their after tax free cash flow in year 7 would be about $1.6 Billion and I used this as a run rate for their remaining reserves.

This is 110% above the current market cap and would put them more in line with their peers.

Usually I don’t necessarily like to use NPV calculations because they are prone to errors. But in this situation the assumptions are pretty reasonable. And it highlights management track record vs peers and on a stand alone basis, essentially increasing their initial share capital from $2 Billion to an intrinsic value above $12 Billion in 7 years.

Regardless, the six year cash flow projections alone provides a margin of safety.

Note that I also double checked their financials to make sure the numbers align which is something I always do. Overall the margins and costs in 2024 are roughly in line with their presentations.

So why does this opportunity exist?

My first thought when I looked at the company was why aren’t Canadian investors buying because there is potential for a 12% yield in 2025. My best guess as to why investors aren’t buying? I don’t think many investors even know this stock exists.

So then why aren’t funds and larger investors buying?

When I asked the CFO about this he said that 90% of the investors he has spoken to can’t buy the stock until the float and liquidity increases.

This is likely one of the reasons the opportunity exists: Strathcona is 79% owned by Waterous Energy Fund. This was 91% but they just issued an additional 12% to their LPs as per the plans they had laid out at their investor day meeting. It is probably the least liquid stock I have seen in terms of daily volume compared to the market cap with only 30K volume on most days.

So this provides opportunity to buy before:

the shares become more liquid and funds and other investors start buying.

it joins the TSX index sometime in Q2 or Q3.

the company starts returning excess funds to shareholders through special dividends or buybacks starting in 2025.

Public float and liquidity.

When I spoke with the CFO he mentioned they planned on issuing about 10% of the shares held in Waterous Energy Fund to their LPs in Q1, bringing total float to 20% - and as noted above they did this in late January. With the 20% they are now able to enter the TSX index which they expect to occur sometime in Q2/Q3. The stock needs to meets pre-listing liquidity requirements and trading volume thresholds for several weeks before it is listed. Based on my calculation $2.5M in shares would have to traded daily to meet this requirement. So volume would have would have to be around 90,000 shares per day at current prices.

Capital returns

How capital returns play out will depend on the price of oil, where the shares are trading, public float (and liquidity), and any potential tuck-in acquisitions.

The most likely scenario right now is that they pay excess funds as special dividends (one or two times a year). Currently they are paying $.25 a quarter in dividends. But if the stock is still trading anywhere near current levels when liquidity and float increases they will very likely focus on buybacks. When I asked the CFO when that could start he said most likely in late 2025 when float reaches 50%. Note that all shares should end up being distributed within 3 years.

Adam Waterous, the chairman (and who I would describe as the unofficial CEO), mentioned that at $30 the stock is just too undervalued and buybacks would be their priority.

Either of these scenarios; paying special dividends and stock buybacks should help re-rate the stock and give it some much needed attention.

Potential tuck-ins and using the shares as currency

There is some risk however that dividends specifically could be delayed. They have a history of making acquisitions so I asked about potential acquisitions.

The CFO said that their preference has always been to find accretive acquisitions but right now they will only look to do tucks-in at the right price. However, the chairman did say that buybacks would be their best investment at these prices but they have to wait until the float increases.

When I asked about potential tuck-ins the CFO said they would be roughly in the $200M range, about one quarter’s worth of free cash flow. The chairman also said the same thing in another presentation I watched.

The most likely scenario is they will do the occasional tuck-in acquisition when the opportunity presents itself or instead pay special dividends until buybacks become an option then that would be their first use of capital at these prices.

They don’t plan on doing any larger acquisitions (~$1B+) until their share price rises significantly. At that point they would use their shares as currency for any potential larger acquisitions and, importantly, they explicitly stated they would not add on any more debt.

This gives me the sense that they are incentivized to get the market to re-rate the stock so they can look at a bigger pool of investments or use their stock instead of cash to make smaller acquisitions.

More on Incentives

There is no share based compensation and insiders even required to buy shares in the open market to meet a minimum target, which is great to hear if you are a shareholder. Members of the BOD and management have up to 60-80% of their net worth in the stock. The CFO was no exception. They are all in and management and the board are highly aligned with shareholders.

As Munger said “show me the incentive and I’ll show you the outcome”.

Debt

Net debt right now is about $2.5B with a blended rate near 6%. Management said they are comfortable with this and don’t plan on going over this amount and won’t issue more debt even for an acquisition. Their leverage ratio (Net Debt/EBITDA) at Q3/2024 was only 1.17.

Risks with the growth plan

The growth plan has two components 1) a drill-to-fill with the excess capacity and 2) de-bottlenecking brownfield projects.

When I asked how risky the growth plan is on a scale of 1-10, the CFO mentioned that if we consider maintenance capex at 1 (being pretty low risk) he would place the first portion of the plan, the drill-to-fill at just 2, only one level higher.

For the de-bottlenecking brownfield projects he put that at 5. And the main risk here is timing and cost overruns but management has a proven record of delivering and emphasized one of their main goals has always been to reduce the risk with their projects and acquisitions.

Importantly, the company’s growth plan does not include new greenfield projects so that reduces risk pretty significantly. But I asked anyways just to get a sense of how he views these projects and he said he would put the risks here in the 7-8 range.

Overall their growth plan looks low risk and if history is any guide they will likely execute on target.

Why oil sands is less risky than shale

I included this section because oil sands producers are in effect competing with shale oil so a better idea of how the two compare could help investors.

Generally, the oil sands have a much higher concentration of oil per location and differ in the type of oil and how it is extracted. It requires higher investment upfront but then produces more stable cash flows.

For shale, the same amount of deposits will stretch over an area that is 10-20 bigger. This increases risks and costs to drill and maintain production. On average shale’s yearly base decline rate is about 40% vs only 10-15% for the oil sands. That is very significant. That lowers capital spend significantly and cuts the need to constantly find new profitable wells to drill thereby lowering risks. Overall it is just more stable. Once the initial big investment is made, it is like a cash flow machine.

On this topic, here is the same peer comparison slide I included earlier with management’s view of break-even costs for their US E&P peers. This may be the most surprising part of the presentation.

Management thinks the true full cycle break-even for shale is near $70 when you account for depletion. At $71 WTI they think US E&Ps are earning only 3% on their capital. That is well below the 10 year T-bill and that is not a consensus view. And in the presentation Adam Waterous half-jokingly mentioned this is why he never gets invited to shale conferences.

Are they correct in this assessment? I don’t know but if you go through a lot of US E&P presentations it is often difficult to find their break-even price. So you don’t always know what you are buying. Which is strange because it should be on the first page of their presentations for investors to see.

OXY who owns some the lowest cost shale plays in the Permian actually took out a note from their presentations showing a $40 break-even, a while ago. A quick look at their 2024 earnings shows that break-even is somewhere in the low to mid $50s. And with their recent CrownRock acquisition you have to begin to wonder how much low cost Tier-1 acreage is left in the Permian and the US in general.

My view is that there are a lot of unknowns with shale as it is still a relatively new sector. We will only know the real returns in hindsight but overall it is fair to say that it is a lot riskier than the oil sands projects.

Risk of Tariffs

The Trump administration is considering putting a 10% tariff on Canadian oil imports.

About 35K of Strathcona’s current production which is about 19% is sold to the US. When I asked the CFO about this his view is that the impact won’t be great but there are unknowns. I wrote a more detailed write up on this but excluded it because it gets complicated looking at all the scenarios and the truth is oil executives in Canada or the US don’t know the true impact if it goes through.

Big picture, the Canadian oil will have to end up somewhere otherwise the supply will not meet demand. You also have the TMX pipeline which has additional capacity to re-route 5-10% of total Canadian production if needed. And if prices rise because of a disruption in Canada these rising prices could allow producers to ship oil the West coast to sell overseas.

What helps give Canadian producers a lot of leverage here is that the US needs Canadian oil and most US refineries are already built specifically for the heavy crude oil coming from the oil sands region and it unlikely that changes because of the costs and time involved to switch to a different grade of crude.

The US produces 13 million barrels a day but uses about 20 million barrels daily. They are net short 7 million barrels a day that need to be imported. How likely is it they put themselves in a bigger deficit and stop importing oil from Canada that already has all the infrastructure in place? If it happens it will very likely be short lived but the headline risk will likely scare investors.

Tariff Hedges

All that said, here is a simple way to reduce risk. Buy 6-9 month expiration puts in Canadian producers like ATH, CVE and MEG that are more exposed until there is resolution on the tariff issue. This should help reduce the risk from tariffs whether real or perceived.

Personally I bought CNQ puts for the following reasons:

You’ll note above that management outlined CNQ as the best comp in the Canadian oil sector and even called SCR a “mini-CNQ, for 50% off”. Their production profile is very similar to SCR and CNQ trades at twice the multiple when factoring in the size difference.

So I am buying some puts here to 1) lower the potential risks and/or headline risks associated with tariffs and 2) as a pair trade simply based on valuation as they are valued at twice the multiple of SCR.

An added benefit is that the cost of the puts I have in place should more than be covered by the dividends SCR can pay in 2025. Is a pair trade necessary here? No but adding short-term puts would lower risk while I wait for the thesis to play out this year.

Potential Risk with LPs

With low float and low volume there is always the chance that some LPs sell when they receive their shares. But from speaking to the CFO it seems most of their partners are in it for the long-term. This is a risk, you never know when or why a shareholder might need to sell. But my guess is even if there is selling pressure, at some point this low liquidity will be an opportunity for supply/demand dynamics to shift favourably when buyers start coming along this year.

Conclusion

To conclude, catalysts are on the horizon including a combination of 1) special dividends which would get investor’s attention 2) increased float and index inclusion that could create forced buyers, and 3) buybacks coming likely later this year.

This is a long-term hold for me. There is a very high likelihood in a few years the stock is much higher with the real potential that it moves higher much earlier than that.